image Source : Click Here

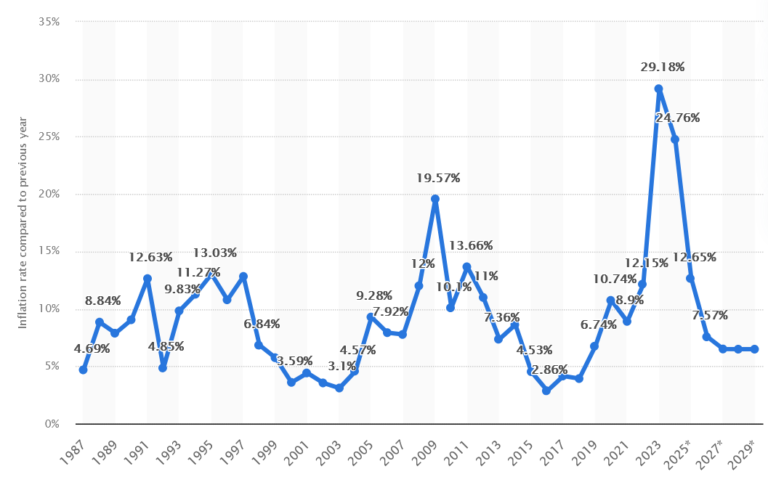

Currency Devaluation in pakistan

Better Investment Opportunities in Pakistan

Other investment options in Pakistan, such as mutual funds or stocks, may offer higher returns, especially in the long run. For example, the Pakistan Stock Exchange (PSX) has shown significant growth in recent years, with some stocks offering returns of up to 20-30% per annum. However, these investments come with higher risks, so it’s essential to assess your risk tolerance and financial goals before investing.