House on installments Raiwind Road

House On Installments Raiwind Road We have a beautiful Spanish-style house for sale on Raiwind Road, Lahore. It’s available on

When considering real estate investments, Dubai has often been the focal point for global investors due to its glamorous lifestyle and towering skyscrapers. However, for Pakistani investors seeking a more lucrative and cost-effective alternative, investing in hotel apartments in Pakistan offers compelling advantages. This article provides a detailed comparison between the real estate markets in Dubai and Pakistan, demonstrating why the latter is an attractive choice for high returns and better value.

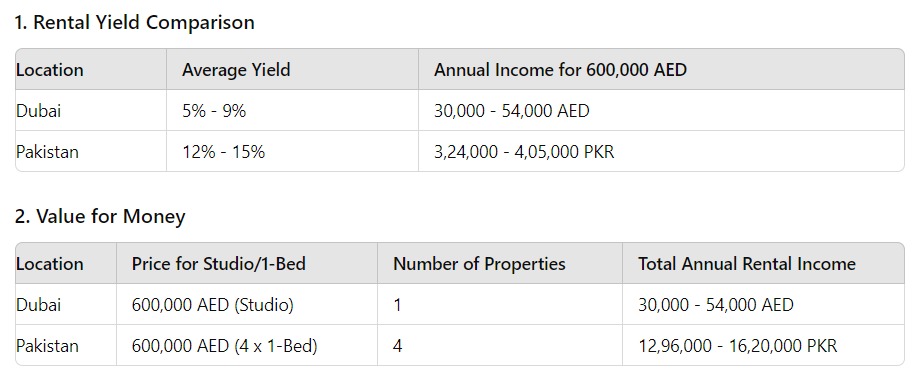

To effectively compare the investment potential between Dubai and Pakistan, let’s examine key factors such as rental yields, property prices, and potential returns.

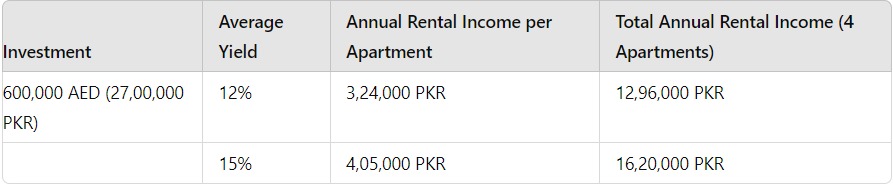

Price for 1-Bedroom Hotel Apartment: Approximately 600,000 AED (equivalent to 27,00,000 PKR)

Number of Apartments: 4 (for the same investment of 600,000 AED)

Guaranteed Rental Income: 12% to 15% annually

Annual Rental Income per Apartment:

For each one-bedroom hotel apartment:

So, the annual rental income per apartment ranges from 3,24,000 PKR to 4,05,000 PKR.

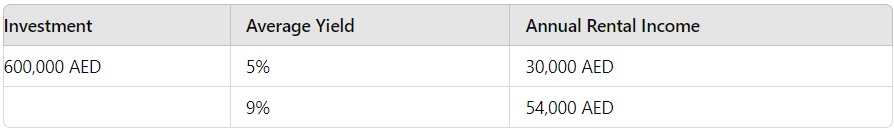

Annual Rental Income:

For an average studio apartment costing 600,000 AED:

So, the annual rental income ranges from 30,000 AED to 54,000 AED.

In Dubai

In Pakistan

In Dubai, 600,000 AED generally buys a single studio apartment. In contrast, this amount in Pakistan can secure four one-bedroom hotel apartments. Here’s a breakdown of potential returns:

If You want to Consult about Investments Request Call Now

1. Higher Rental Yields

Pakistani hotel apartments offer rental yields between 12% and 15%, a considerable improvement over Dubai’s 5% to 9%. This means investors in Pakistan receive a higher return on their investment annually.

2. Greater Value for Money

Investing 600,000 AED in Dubai typically secures a single studio apartment, whereas the same investment amount can purchase four one-bedroom hotel apartments in Pakistan. This diversification across multiple properties mitigates risk and enhances income potential.

3. Increased Rental Income

The combined annual rental income from four hotel apartments in Pakistan significantly surpasses the income from a single studio apartment in Dubai. With potential earnings ranging from 12,96,000 to 16,20,000 PKR compared to 30,000 to 54,000 AED in Dubai, Pakistani investments offer a substantial financial advantage.

For Pakistani investors looking for a high-return, cost-effective real estate opportunity, hotel apartments in Pakistan present a superior option compared to Dubai. The combination of higher rental yields, better property value, and increased income potential makes Pakistani hotel apartments a compelling choice.

Investors should consider leveraging this opportunity to maximize their returns while diversifying their real estate portfolio. Consulting with a local real estate expert can provide further insights and guidance tailored to your specific investment needs.

House On Installments Raiwind Road We have a beautiful Spanish-style house for sale on Raiwind Road, Lahore. It’s available on

Benefits of Investing in Apartments vs. Houses When considering real estate investments, choosing between apartments and houses can be pivotal.

Why Investing in Pakistani Hotel Apartments is a Better Choice Than investing in Dubai When considering real estate investments, Dubai